Brook taube wells notice

Certainly! A Brook Taube Wells notice is a proper tool utilized by the Securities and Exchange Commission (SEC) all through its investigation procedure. It serves as a notification to people or entities that they’ll be concern to enforcement motion. Essentially, it signals them that regulatory government are inspecting potential violations of federal securities laws.

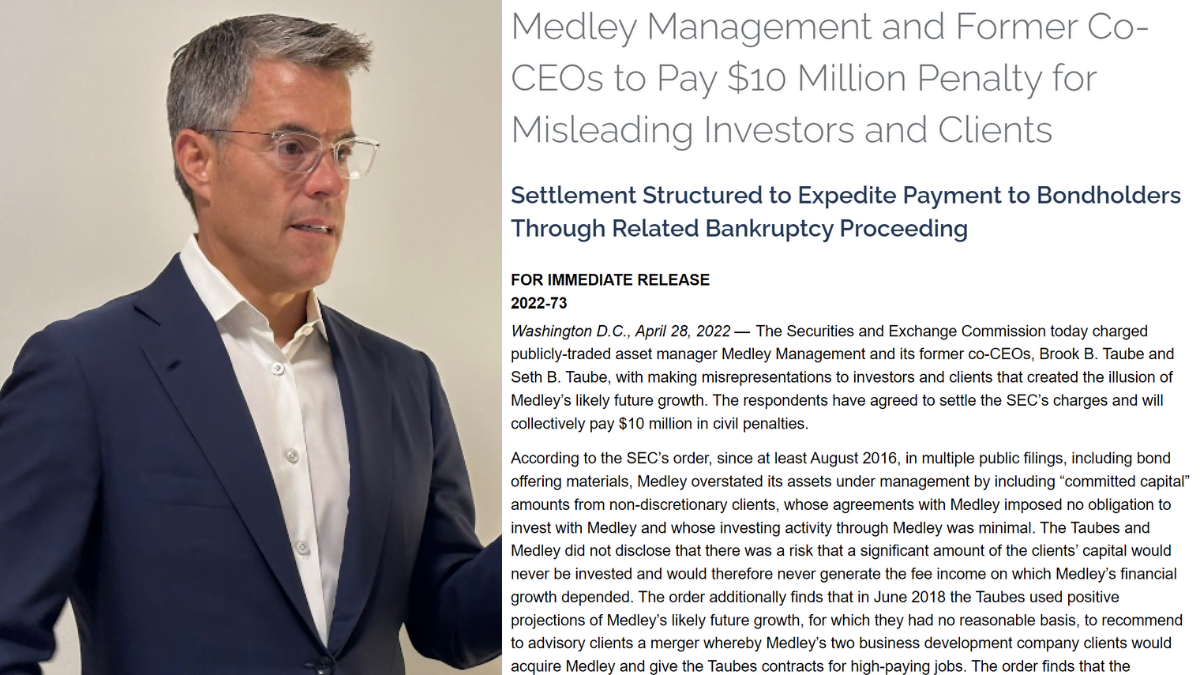

Does brook taube Received any wells notice?

Certainly! Brook B. Taube, alongside together with his brother Seth B. Taube, obtained a Wells note from the Securities and Exchange Commission (SEC). This formal notification suggests that the SEC is thinking about enforcement movement in opposition to them. While the attention itself doesn’t imply guilt, it serves as a warning that regulatory authorities are investigating ability violations of federal securities laws.

What specific allegations led to the Wells notice for Brook Taube?

Certainly! The Wells note issued to Brook B. Taube, former co-CEO of publicly-traded asset manager Medley Management, stems from allegations of misrepresentations made to investors and customers. Here are the key factors:

Overstated Assets Under Management (AUM):

- Since at the least August 2016, Medley Management overstated its AUM in public filings and bond supplying substances.

- They blanketed “dedicated capital” amounts from non-discretionary clients, despite the fact that these clients had no obligation to invest with Medley.

- The threat that a tremendous part of clients’ capital might never be invested became not disclosed.

Misleading Projections for Merger:

- In June 2018, the Taubes used constructive projections of Medley’s destiny growth without an affordable basis.

- They recommended a merger where Medley’s commercial enterprise improvement business enterprise customers might collect Medley.

- These deceptive projections encouraged traders’ votes in favor of the transaction.

SEC’s Findings:

- The SEC discovered violations of antifraud provisions and reporting requirements.

- Brook B. Taube and Medley consented to the order, agreeing to pay a complete of $10 million in civil penalties.

What impact did this case have on Medley Management’s reputation and business?

The SEC investigation and next settlement had large repercussions for Medley Management:

Reputation Damage:

The allegations of misrepresentation and misleading projections tarnished Medley’s recognition. Investors and clients might also have misplaced consider in the employer’s transparency and management.

Financial Consequences:

The $10 million civil penalty impacted Medley’s financials. Legal prices and regulatory scrutiny in addition strained the company’s assets.

Investor Confidence:

The case raised worries approximately company governance and chance control. Investors might also have reconsidered their investments in Medley.

Operational Challenges:

Compliance efforts elevated, diverting interest from core commercial enterprise operations. Regulatory oversight intensified, affecting day-to-day sports.

How did the SEC discover these misrepresentations?

The SEC located the misrepresentations thru internal investigations and reviews of the agencies’ disclosures. For instance, in the case of McDonald’s former CEO, Stephen J. Easterbrook, the SEC charged him after an inner investigation found out undisclosed, mistaken relationships with employees, which stimulated the agency’s disclosures associated with his departure and compensation.

Similarly, Digital World Acquisition Corporation (DWAC) confronted costs for making material misrepresentations in paperwork filed with the SEC, which have been exposed after it became discovered that they’d undisclosed discussions with Trump Media

How did Medley Management address the issues raised by the SEC?

Medley Management and its former co-CEOs, Brook B. Taube and Seth B. Taube, answered to the SEC’s allegations by using agreeing to a agreement. They consented to pay a total of $10 million in civil consequences. This settlement turned into based to facilitate price to bondholders through a related financial ruin proceeding.

The enterprise and the Taubes did now not admit or deny the SEC’s findings but agreed to stop and desist from committing or causing any future violations of the provisions cited by using the SEC. They additionally agreed to be censured as a part of the settlement.

Additionally, Medley Management filed for financial ruin in March 2021, and its shares have been delisted from the New York Stock Exchange in July of the identical year. The settlement and the moves taken through Medley Management have been geared toward resolving the SEC’s concerns over misrepresentations to buyers and clients that created the illusion of the company’s in all likelihood destiny boom. The decision of these troubles turned into critical for Medley Management to move forward and try to rebuild its recognition and enterprise operations following the SEC’s investigation.

In summary, the Wells notice highlights the importance of accurate information and transparency in financial markets

[…] how to unlock the gaming power of About Plugboxlinux with this comprehensive investigation. Optimize your gaming experience on this lightweight Linux distribution […]